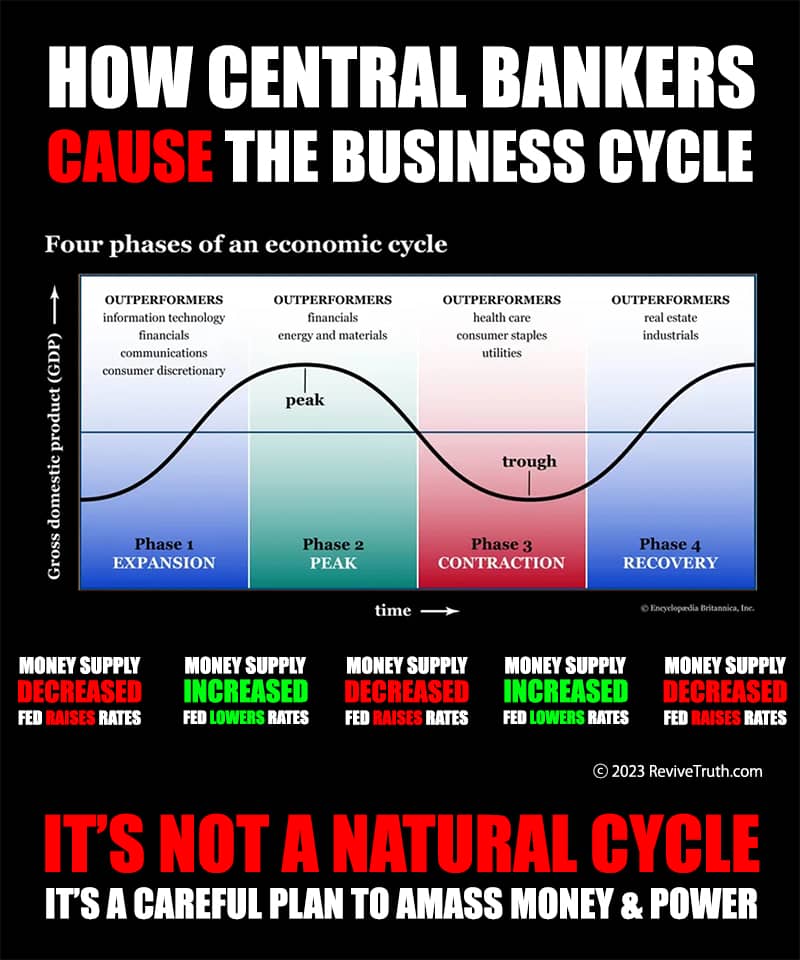

The “business cycle”, that is, the supposed natural cycle of the economy of ups and downs, is a fraud. It is orchestrated by the central bankers manipulating the money supply. The peaks and troughs, recessions, inflation, depression and hyperinflation, are all caused by the manipulation of a fiat money supply by central bankers.

It is not an accident, it is not a cycle; it is a planned and orchestrated attack on our economies. It is a manmade problem, carefully planned, and directly caused. Recessions and inflation are not natural. They are created by the shrinking and expansions of the money supply.

Recessions and how the central banks cause it

In a recession (or depression), which means that there is not enough money in the money supply to facilitate commerce (resulting in a higher value on the money itself), those with money and a job are overpaid, but the economy shrinks because there is not enough to go around, and the job market declines because of a chain reaction of events as a result of money scarcity.

The quality of goods and services increases in recessionary environments because the money is worth more (so businesses are being overpaid), and because the products are more scarce, so businesses must work harder to fight for access to the buyers.

But because buyers are more scarce in recessionary environments, businesses have to scale down operations, and cash flow decreases, because there is not enough, and the quantity of goods decreases, because there is not enough money to produce or to buy inventory for sale.

And the services become more scarce, because without as many buyers, and with a reduced supply chain, and reduced buyers, many businesses go out of business, and less goods are produced or sold, resulting in less availability of products and services.

And because of less commerce due to the lack of money in the money supply in a recessionary environment, there are less jobs, because the supply chain is bottlenecked by the insufficient money supply.

And with less products and less buyers, and because those with jobs are overpaid due to the increased value of the money, businesses cannot afford to hire as many employees, and some businesses are forced to fire employees, and many businesses go out of business thereby decreasing employment opportunities.

The bankers and globalists profit from recessions because they can centralize power by buying up resources at less than they are worth, as well as putting competitors (small businesses) out of business, further centralizing power and control.

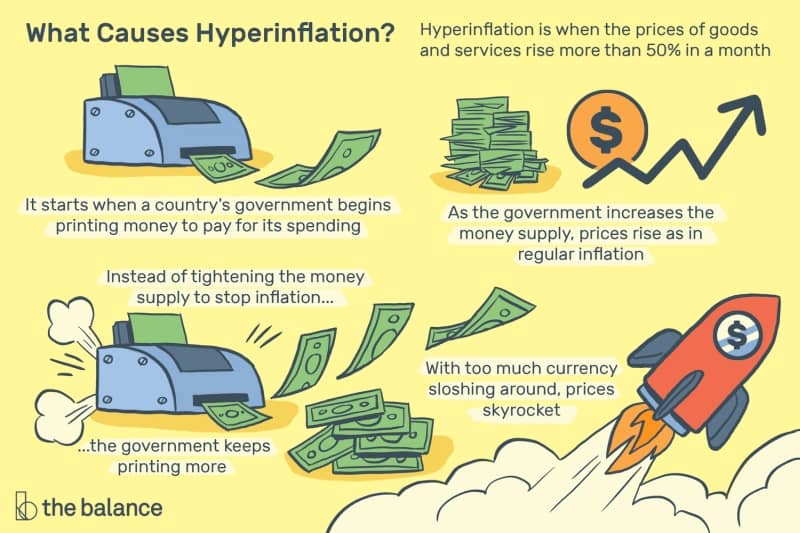

Inflation and how the central banks cause it

Meanwhile, in an inflationary environment (or hyperinflation), which means that there is too much money in the money supply (resulting in a lower value on the money itself), there are more jobs, but everyone is underpaid, because the money is worth less.

Although the economy grows during inflation, because businesses can hire more employees since they are underpaid, the prices of goods and services go up and the quality goes down, because the businesses are being underpaid for these goods and services, since the money is worth less.

And because an inflationary environment is strategically created following a recession, those large corporations gain huge amounts of wealth during inflationary times, because while commerce is increased, many of their competitors were put out of business during the recession period. Yet, employees are underpaid, because the money is worth less.

This thereby increases monopolies and harms small business, because when the next recession is created by the central bankers by reducing the money supply, thus dropping prices, these large corporations then buy assets at a lesser value than they are worth, so the inflation period works as a time to manipulate the market to centralize money and power with the bankers and large corporations.

The quality of goods and services decreases in inflationary environments because the money is worth less (so businesses are being underpaid), and because the products are more plentiful, so businesses get lazy and adapt to a plentiful marketplace, because there is less competition since the buyers are plentiful.

The bankers and globalists profit from inflation because they can centralize power by amassing wealth and power on the heels of the created recession that preceeded, and then use this wealth to centralize resources and power in the created recession that follows.

The “business cycle” is a fraud

As shown, the business cycle, that is, the ups and downs of the economy, are not natural but planned and carefully orchestrated to benefit the central banks at the expense of society as a whole.

What they teach in business school and economics classes about peaks and troughs as a cyclical environment is nothing but a total fraud to divert future business students from learning the truth that the central bankers are controlling everything behind the scenes by printing money and shrinking the money supply, and by controlling interest rates, to benefit from the chaos they cause.

Therefore, the central bankers are the cause of all of our economic problems, it is all a plan to amass wealth and power, and is directly caused, planned and orchestrated to centralize power and resources in the hands of the bankers and the corporations who are owned by the bankers.